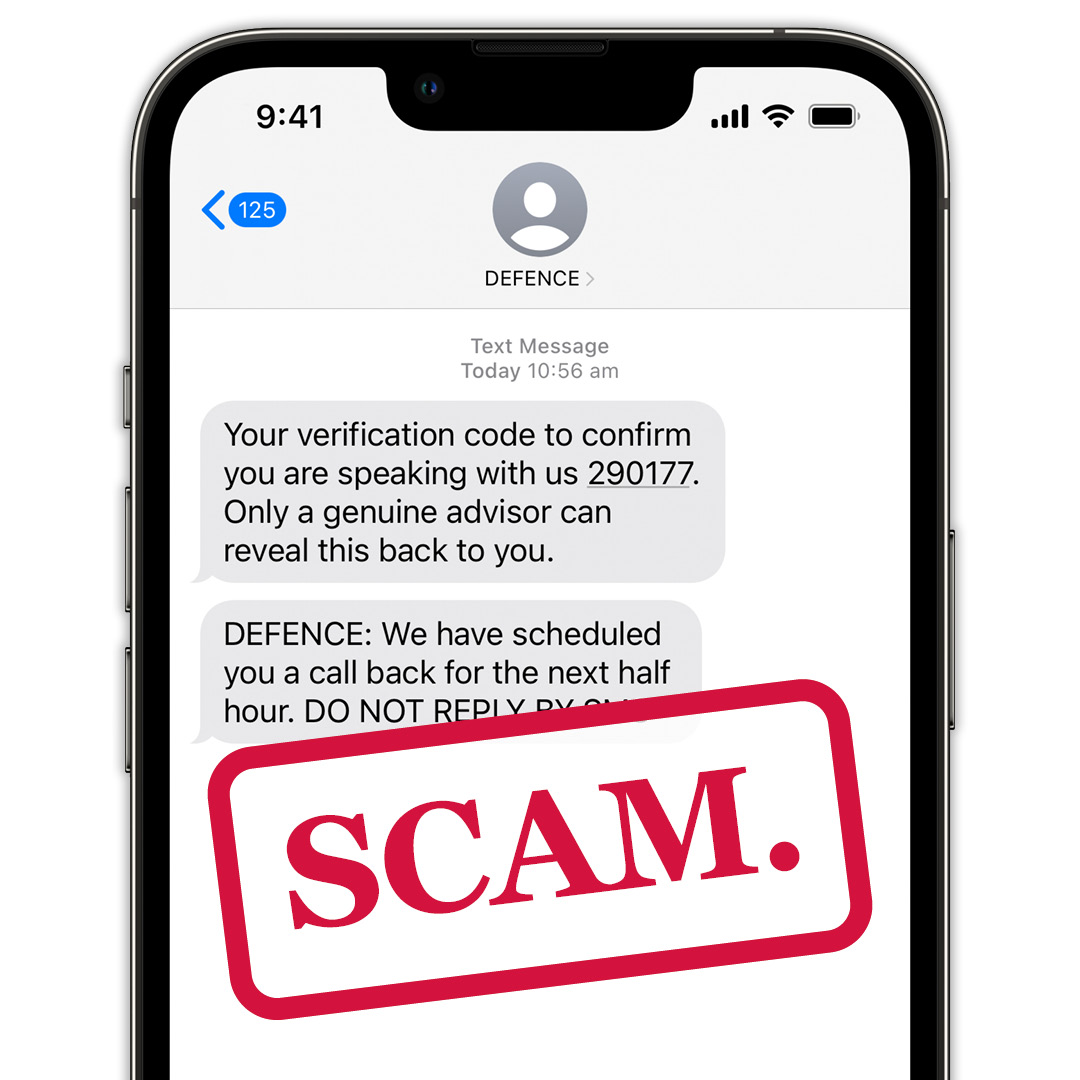

Bogus calls and SMSs are on the rise, and scammers are using old tricks in new ways.

The latest involves scammers mimicking the fraud team from a financial institution. They are contacting startled consumers with scaremongering calls and SMSs. For example, credit card details have been fraudulently used to purchase an item in an exotic country they have never visited.

Known as “caller ID spoofing”, this blatant impersonation scam uses real phone numbers – and sometimes yours – to scam others. It also creates fear and urgency through the threat that a fraudulent transaction is underway using the shaken customer’s money.

How does caller ID spoofing work?

Caller ID spoofing allows the scammer to exploit robocalling technology to disguise their identity, and often by displaying an Australian number, thus increasing the chance you would answer the call.

Typically, these callers are located overseas and may be impersonating a local bank, a government agency, or a telecommunications provider to commit fraud by obtaining your personal or financially sensitive information.

To add validity to the phone contact, the phoney callers are claiming to be a member of the bank or telco’s fraud or security team.

“My name is Ron Johnson, and I’m calling from the Acme Bank fraud prevention team.”

Moreover, the scammers will usually present themselves as calm and assured and often shamelessly claim the bogus call is being recorded for quality and security purposes.

To enhance the scam, the charlatans will often brazenly encourage the startled and anxious consumer to ring the number back they are calling from, as the number will reroute back to the company they are professing to represent.

Scammers are using number spoofing because Australians have become suspicious of answering calls from unusual or unknown numbers. The scammers are trying to take advantage of our growing scam awareness, which makes this rip-off doubly devious.

In the case of a credit card transaction, the scammer may even offer to cancel the card and organise a replacement. They have the whole process down pat, so it sounds legitimate.

The fake fraud representative will also tell the unsuspecting customer they will cancel the transaction and send through a code to cancel the payment.

Look for other impersonations.

Scammers may also call you from spoofed numbers that are similar to yours. It’s a new type of spoofing that uses your so-called ‘number neighbours’ against you. It’s a social engineering tactic designed to increase your chances of picking up the phone.

For example, if your number is 0401 000 001, they may call you from 0401 000 002 to increase your chances of picking up.

And some people have received calls from what looks like their mobile number. If you have experienced this, the scammer has spoofed your number and, by accident has called you as a potential victim, so it looks like you are calling yourself. If this occurs, contact your telco immediately.

How can you protect yourself?

Stay alert to scam calls and SMS messages. The SMS or caller might say they are from your bank or telco, but it doesn’t always mean this is true.

Also, be wary if the call comes out of the blue. The best action is to immediately hang up on callers and contact your bank or telco on a number published on its website.

If the caller uses your details, such as an account number or credit card number, hang up immediately, as the scammer has obtained this information fraudulently.

Play it safe.

If you have lost money to a scam like this you should contact your bank or financial institution as soon as possible and report the matter to police and to ACCC’s Scamwatch.

Unfortunately, the bad news is that once your money is gone, it can be a major challenge to recover your funds. If you’ve handed over money or given strangers access to your accounts – then your chances of getting your money back are limited.

If you have any questions or concerns about any suspicious activity on your account, please call us on 1800 033 139.

Important note: This information is of a general nature and is not intended to be relied on by you as advice in any particular matter. You should contact us at Defence Bank to discuss how this information may apply to your circumstances.