Can help reduce interest payable on your home loan.

A day-to-day digital banking account.

Zero local online transaction fees.

Access to our award-winning app.

For whatever you need, for whatever’s ahead, the Home Loan Offset account is the way to manage your day-to-day banking to reduce the interest payable on your home loan.

The Home Loan Offset account also gives you zero local online transaction fees, extensive digital banking choices and access to our award-winning app.

Key features.

- No monthly account-keeping fees.

- Access to fee-free cash withdrawals at Defence Bank ATMs and also at all big four banks Australia wide - ANZ, Commonwealth Bank, Westpac and NAB.

- All the convenience of digital banking.

- Faster, simpler ways to make payments.

- Your choice of Camo-coloured Visa Debit card.

- Immediate transfers between institutions.

- Compatible with digital wallets from Apple, Garmin, Google and Samsung.

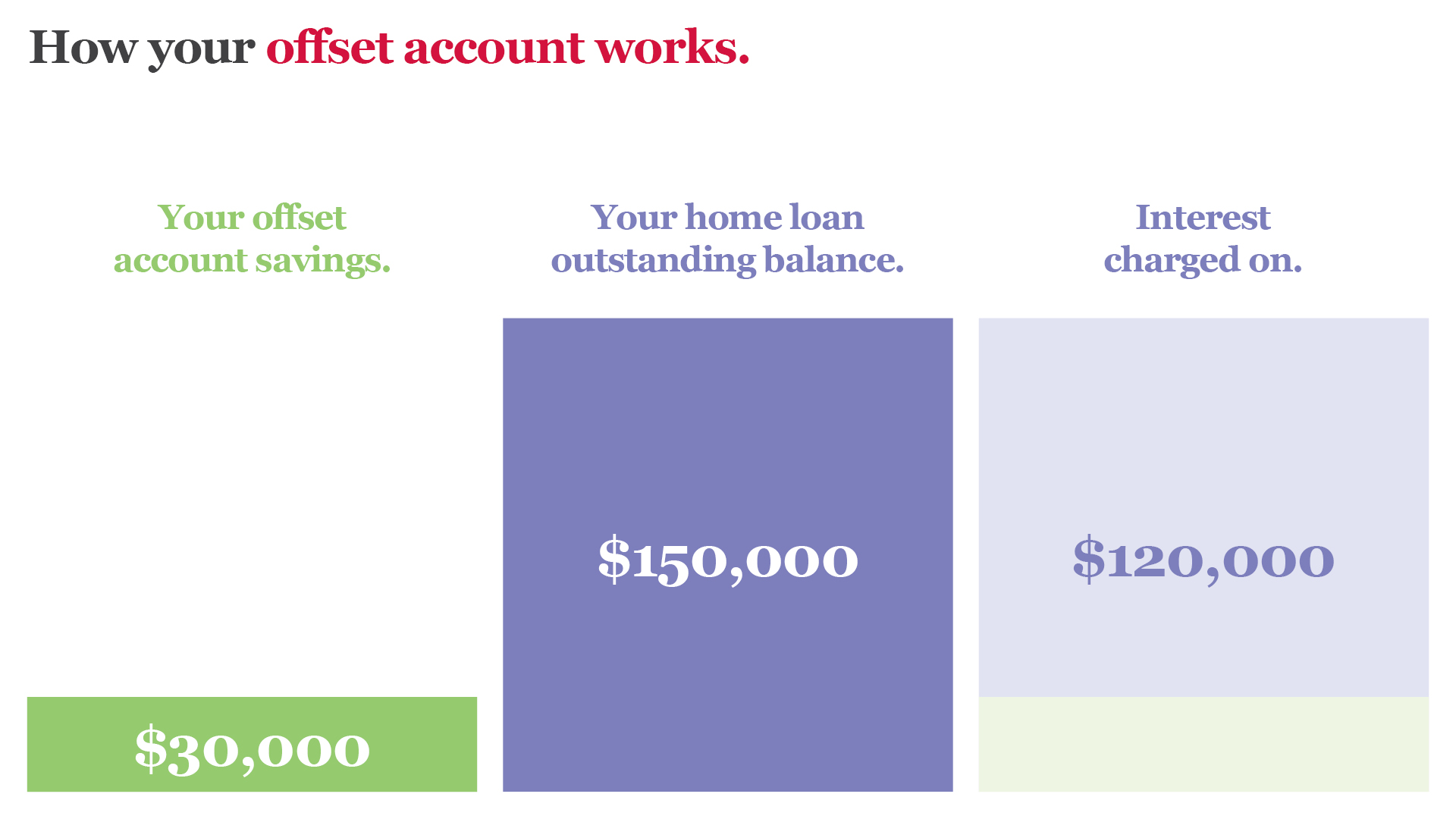

The Home Loan Offset account works by using 100% of the balance to ‘offset’ or effectively reduce the portion of your home loan accruing interest. For example, if your Defence Bank home loan had a balance of $150,000 with $30,000 linked to our Home Loan Offset account, you would only pay interest on $120,000 of your loan balance.

To get everything running super smoothly, you’ll need to have the facility set up by your home loan consultant. Or contact your nearest branch or our Contact Centre on 1800 033 139 to arrange.