On 18 March 2025, we proudly celebrate our 50th anniversary.

From our humble beginnings at Victoria Barracks in Melbourne to where we are today, our mission has always been the same: to offer a trustworthy banking alternative for our members and their families who serve our country. We’re deeply grateful for your trust and support along the way. Scroll down to see some of our key milestones and the journey we’ve shared in supporting the ADF over the past 50 years.

A message of thanks from our CEO, Roberto Scenna.

A big thank you to all of our members for banking with us and for being part of an organisation with such a proud history and we look forward to serving you in the future. "

A big thank you to all of our members for banking with us and for being part of an organisation with such a proud history and we look forward to serving you in the future. "

When it all began.

At the end of the the Vietnam War, many returned servicemen were frustrated with the support systems available for them and their families. They started talking about how to manage their finances better, especially with the payments they were receiving after service. Most importantly, they wanted a bank that understood their unique needs as ADF members.

In March 1975, the Defence Forces Credit Union Co-operative (Melbourne) was established at Victoria Barracks in Melbourne. This was part of a larger wave of credit union growth across Australia.

Move, mergers and growth.

In the early 80s, the Defence Credit Co-Operative Limited moved its head office to 332 St Kilda Road, South Melbourne, to support future growth. By 30 June 1981, we had 1,024 members and assets of $811,000.

It was at this time that we started using Defcredit as our trading name.

Over the next few years, we went through three major mergers. By 1987, we had grown to 28,000 members, $65 million in assets, and 34 branches. These were key moments in our journey to becoming the Australia-wide, member-owned bank we are today.

More mergers, better access for members and expansion into the Navy.

In 1995, we officially changed our name to Defence Force Credit Union Limited which was still referred to as Defcredit.

The 90s was a time of further expansion with AAFCANS Employees Credit Co-operative and Army Credit Union Ltd (Townsville) merging with us, growing our bank to $200 million in assets.

The 90s was also a time of wider bank access for our members. We saw the introduction of Defcredit Direct in 1995, a 24/7 Telephone Banking Service also available to members posted overseas. Our members also gained access to all ATMs (excluding Commonwealth Bank) across Australia from 1997.

To provide better service to our Navy members, we opened two new branches at HMAS Albatross and HMAS Cerberus in 1999. This move provided Navy servicemen and women greater access to our bank and established our intent as a bank for all Defence services.

The birth of digital and the start of DHOAS.

In 2000, we gave members better access to banking services with the launch of Internet Banking on the Defcredit website. This gave members the ability to check balances, make transactions, and pay bills from anywhere. We also opened new branches at HMAS Kuttabul and HMAS Stirling expanding our Navy presence.

We continued to embrace technology and innovation. In 2004, we became the first credit union in Australia to upgrade our ATM network with advanced encryption software.

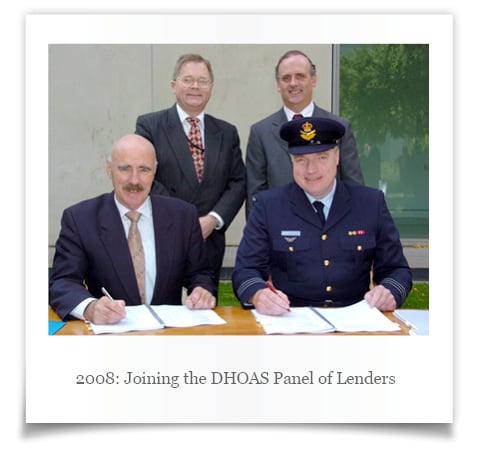

In 2008, we were chosen to join the DHOAS Panel of Lenders, becoming one of only three banks to offer the scheme. Since then, we have proudly helped thousands of ADF members achieve the dream of homeownership.

Becoming a bank and embracing technology.

In 2010, we reached $1 billion in assets, and the following year, moved our head office to Level 5, 31 Queen Street, Melbourne, where we remain today.

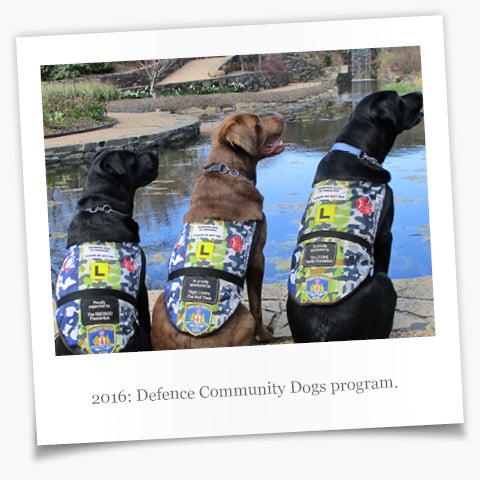

This was also the decade we officially became Defence Bank, rebranding in 2012, and launched the Defence Bank Foundation. By 2016, we introduced the Defence Community Dogs program, the sole beneficiary of our Foundation.![]()

To better serve our members, in 2014, we unveiled our "Branch of the Future" design and launched a national team of mobile Home Loan Consultants.

We also stayed ahead of the curve with technology, launching a video call centre in 2012; our first mobile banking app in 2013 which later won Mozo Expert's Choice Award - Excellent Banking App in 2019; we introduced Apple Pay and Samsung Pay in 2015 for contactless payments; and we were one of the first banks to offer real-time payments through the New Payments Platform.

A decade of advancements in technology...

2020 to today...

When COVID hit in 2020, we continued serving our members by enabling our team to work remotely. In 2021, we opened a new support office at Level 10, 31 Queen Street, embracing flexible work which we continue to offer today. That same year, we became a provider for the First Home Loan Deposit Scheme, helping members buy homes sooner.

In 2023, we introduced a virtual branch for home and personal loan appointments for even easier access to our lenders and later expanded our fee-free ATM network by partnering with atmx by Armaguard and Next Payments in 2024.

Our focus on our members was reflected by winning 14 WeMoney Awards, including Defence Services Bank of the Year for the third year in a row.

In July 2024, we welcomed our new Chief Executive Officer, Roberto Scenna, marking an exciting new chapter for our bank as we look forward to serving our members in the years to come.

Growing as a bank...

Member spotlights.

Major Craig Montgomery, Defence Bank member for 44 years.

Wherever I've been posted, I've had Defence Bank at my fingertips."

Wherever I've been posted, I've had Defence Bank at my fingertips."